Data

Sanctions 50-Plus

Sanctions 50-Plus

Data

Sanctions 50-Plus

Comply With The OFAC 50 Percent Rule

Kharon provides the most extensive and precise list of “sanctioned-by-law” companies, tackling challenges like multilayered and aggregated ownership chains, cross-jurisdiction and beneficial ownership, and shifting ownership structures.

Kharon’s 50-Plus dataset keeps you ahead of the regulatory curve by providing the most accurate and comprehensive coverage on entities majority owned — directly, indirectly, or in the aggregate — by sanctioned actors, allowing your enterprise to identify and manage risk more effectively while reducing operational costs.

Kharon’s 50-Plus dataset keeps you ahead of the regulatory curve by providing the most accurate and comprehensive coverage on entities majority owned — directly, indirectly, or in the aggregate — by sanctioned actors, allowing your enterprise to identify and manage risk more effectively while reducing operational costs.

Sanctions Compliance Data

Kharon thoroughly follows ownership chains as far down as they extend and across every global jurisdiction by collecting, validating, and analyzing all reliable open-source documentation — corporate records, securities and regulatory filings, company websites and press releases, global media, and social media, among others.

Through rigorous research, investigation, analysis, and quality assurance processes, Kharon generates enriched data of unparalleled precision and depth that fills critical information gaps left by government watchlists, internal grey lists, and third-party adverse media and UBO offerings. These gaps can present hidden risk exposure which can often go undetected.

Kharon’s enriched data is regularly updated to reflect changes in risk dynamics created by new sanctions listings and delistings, as well as shifting ownership structures, that may result in entities either becoming subject to or falling outside the scope of the 50 Percent Rule. Kharon's data provides quality assurance while protecting against overscreening.

Through rigorous research, investigation, analysis, and quality assurance processes, Kharon generates enriched data of unparalleled precision and depth that fills critical information gaps left by government watchlists, internal grey lists, and third-party adverse media and UBO offerings. These gaps can present hidden risk exposure which can often go undetected.

Kharon’s enriched data is regularly updated to reflect changes in risk dynamics created by new sanctions listings and delistings, as well as shifting ownership structures, that may result in entities either becoming subject to or falling outside the scope of the 50 Percent Rule. Kharon's data provides quality assurance while protecting against overscreening.

+Thousands of Majority-Owned Entities

+100+ Global Jurisdictions

+Dozens of Industries

Rapid Response for Sanctions Risk Management

Allocating your internal resources to review and investigate the latest sanctions actions is neither effective nor efficient. Kharon’s 50-Plus Rapid Response offering provides a timely, cost-effective solution that saves your resources from distracting fire drills. Following each new sanctions listing and delisting, 50-Plus Rapid Response promptly delivers the data, intelligence, and assurance you need to screen customers, transactions, and supply chains for compliance with the 50 Percent Rule and make quicker, more informed decisions.

+Comprehensive Coverage

+Reduced Operational Costs

+Protection Against Overscreening

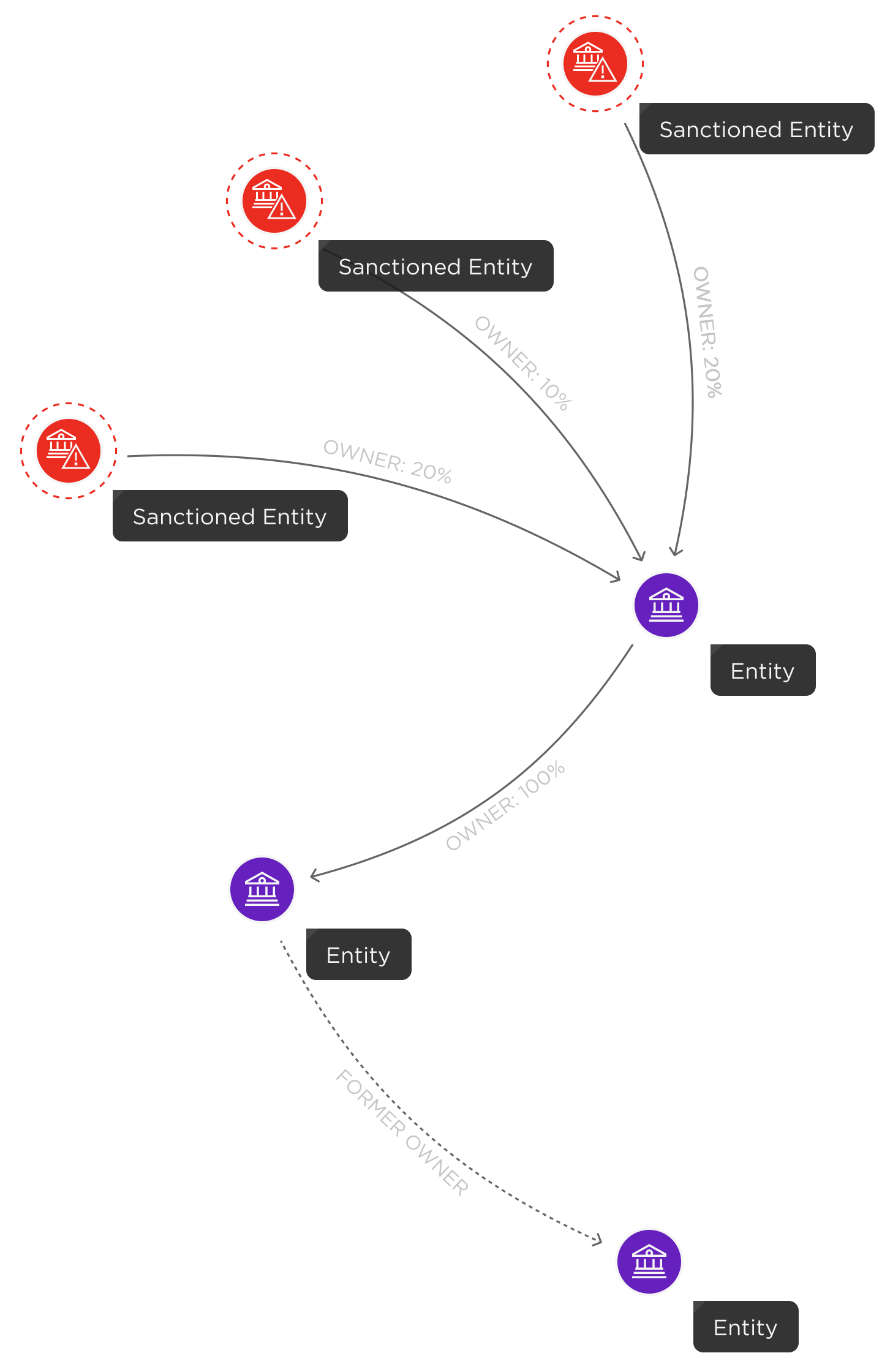

Typology: Complex ownership structures

Ownership interests of sanctioned actors are often opaque and multilayered, involving multiple jurisdictions and parties. Kharon’s 50-Plus dataset covers complex ownership structures that include entities majority owned in the aggregate by multiple sanctioned actors, as well as majority-owned entities that are several degrees removed from the sanctioned parent.

According to Kharon’s research findings, more than 30% of sanctioned-by-law companies are three or more degrees removed from the sanctioned parent — highlighting continuous efforts by sanctioned actors to circumvent restrictions using a combination of evasion tactics and further demonstrating the need for stronger risk management frameworks.

According to Kharon’s research findings, more than 30% of sanctioned-by-law companies are three or more degrees removed from the sanctioned parent — highlighting continuous efforts by sanctioned actors to circumvent restrictions using a combination of evasion tactics and further demonstrating the need for stronger risk management frameworks.

Want a Demo?

Trusted by the world’s leading organizations