Investment Risk

solutions

Investment Risk

Investment Risk Intelligence

Proactively identify investments impacted by sanctions controversies.

Gain a Competitive Edge with Kharon’s Investment Risk Insights

With Kharon, you can look ahead to understand which investments could be impaired by government-administered sanctions, trade controls, or investment restrictions. Assess with unprecedented detail and precision where exposure to sanctions controversies may impact risk-adjusted returns.

Align Your Holdings with Responsible Investment Expectations

Kharon’s Dynamic Exposure Scores let you screen your holdings to proactively detect companies engaged in sanctions controversies like military end use, forced labor, surveillance technology, and restricted jurisdictions. Our solution is a critical and unique alternative data resource needed to ensure that companies sit within your responsible investment guidelines.

Deep Insights into Geopolitical Security Risks Affecting Investments

Our solutions have helped the world’s leading financial institutions and corporates reimagine their compliance and risk management functions. We offer the deepest insights on the broadest range of actors implicated by global sanctions programs—giving you critical new perspectives on geopolitical security risks affecting investments.

Want a Demo?

Our Products

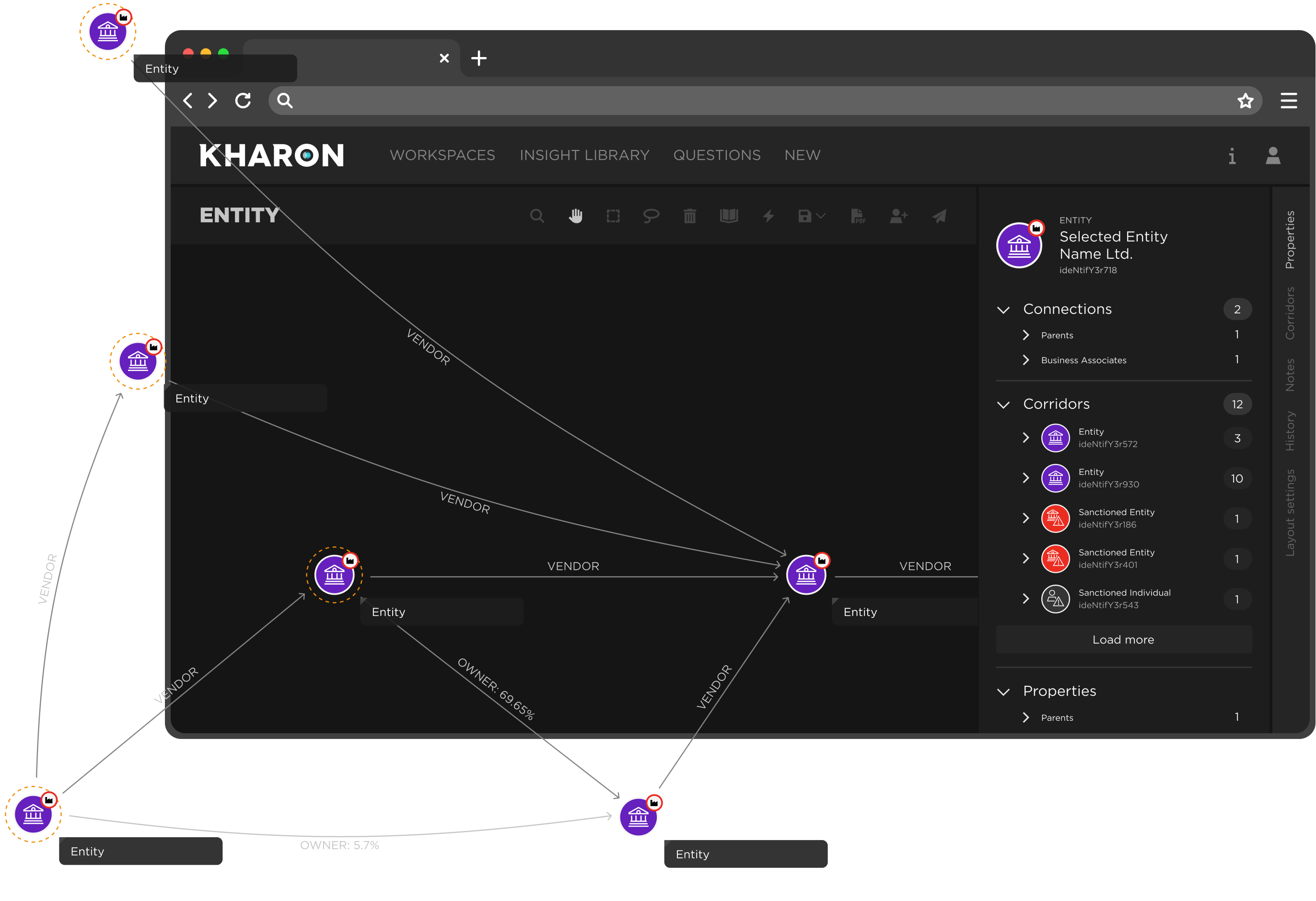

ClearView

The industry leading solution for investigations and analyses. Visualize and understand the connections between risk-relevant parties in a single, powerful platform.

Learn More about ClearView

Our Products

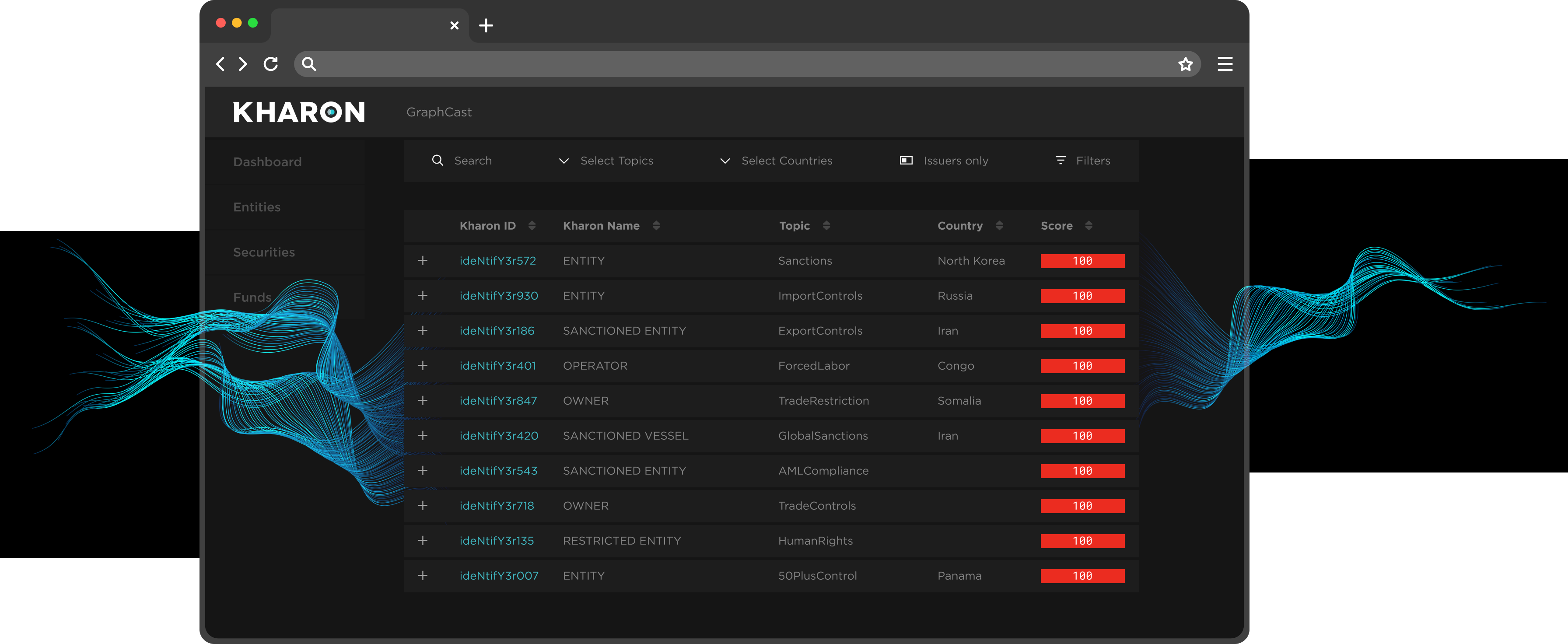

GraphCast

Targeted insights critical for your business and use case, straight from the Kharon Core. Whether looking for insights on sanctions ownership or control, forced labor, Russia, military end use, evasion tactics, or more, GraphCast gives you the world’s best risk data with minimal friction.

Learn More about GRAPHCAST

Trusted by the world’s leading organizations